…and why you should definitely have one if you don’t already!

Alright, gather round. This is going to be important.

Today, we’re talking about checking accounts. Yes, really, checking accounts. It’s a blog about personal finance basics folks. And when I said “basics”, I meant it!

But everyone already has a checking account, right? Why bother talking about it?

Woah there, let’s not make assumptions. There are plenty of people who don’t have checking accounts. Lots of folks don’t trust banks after the banking collapse of 2008 – 2009 and some folks didn’t trust banks even before that! Beyond those folks, there is a whole section of the population who, usually, don’t have checking accounts: kids and young adults!

So this one is for all those folks who don’t have checking accounts, whatever the reason may be. Besides, most of the folks who do have checking accounts don’t understand what they actually are or why they have them in the first place! So everyone can maybe learn a little something.

Checking account basics

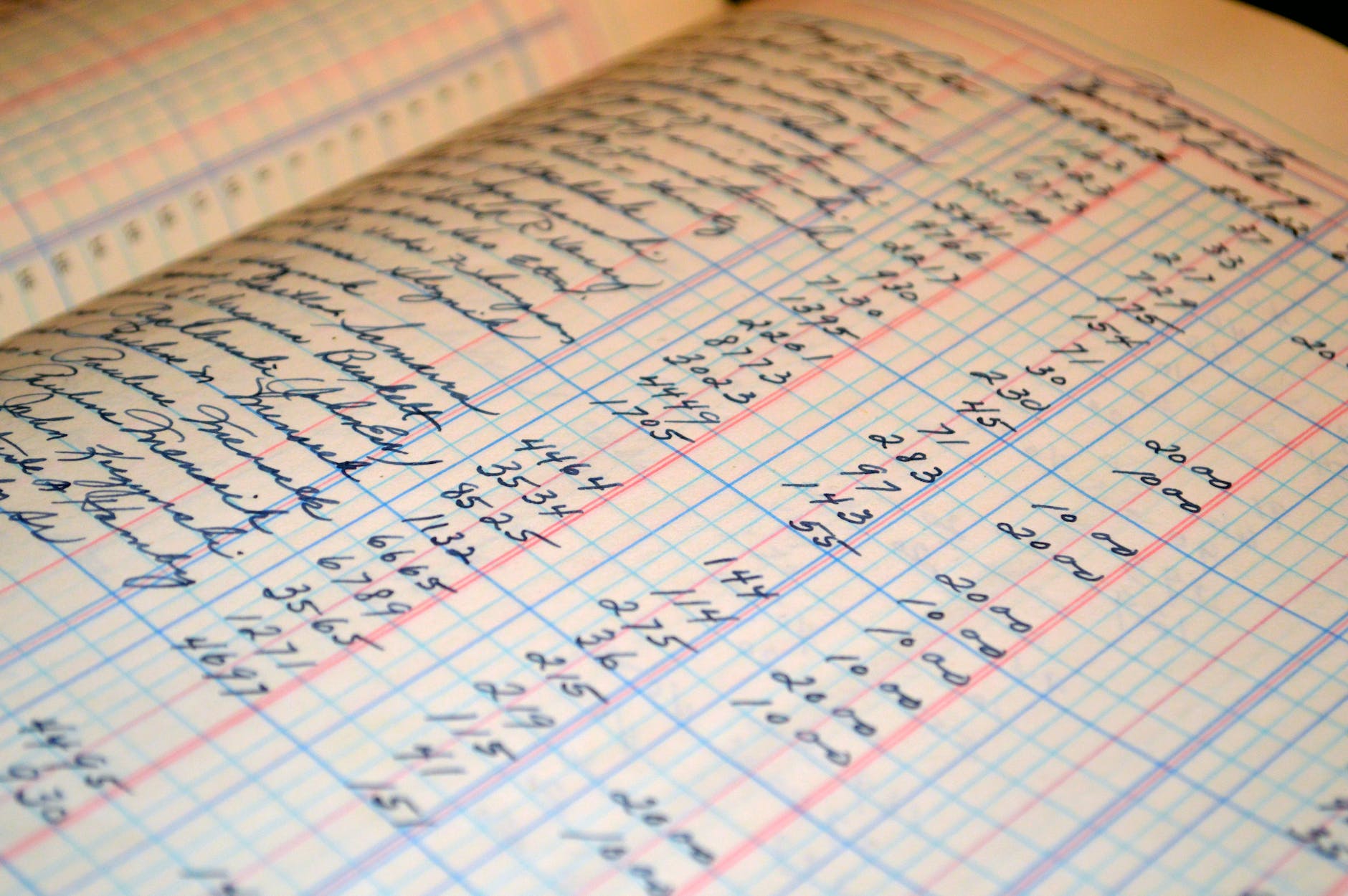

A checking account is basically a score sheet you keep with the bank. You open the account with them, you give them your money, and they keep a tally of how much you have given them in total. Pretty simple right?

So they just keep track of how much money I have?

Well, how much money you have given them at least, yes. You could also have money outside the bank in, say, cash.

In addition to keeping score, the bank also has to make sure you can get the money back out of the checking account as easily as possible, be that through checks, a debit card, or just plain old cash. Don’t worry about all those just yet, we’ll cover them in another post later.

Okay, but I can count just fine. Why do I need to go through all the extra steps of giving the bank my money and then using their systems to get it back out? Why can’t I just use cash?

To be clear, you can do both. Cash is, in fact, one of the ways the bank makes your money available to you. But you raise a good point. Why the middle man? Well, as with many things, there’s a few good reasons.

We’re all accountants in the end

While it’s not the most exciting thing in the world, having a checking account helps keep track of your money, plain and simple. Need to pick up some groceries? If you have a checking account, you can see, at a glance, how much money you have available to go shopping for food. No checking account? Then get counting your cash, assuming you can find it all and you make no mistakes adding it up.

That’s true. It’s nice to be able to know how much money I have just by checking my phone.

Indeed. Even more than that, it’s not just a convenience thing, it’s a safety thing. If you only use cash and miscount, or forget where you put some of your stash, you could incorrectly believe you don’t have enough money for food, or gas, or whatever else you need. That can generally suck, but it could also become a safety issue if that “whatever else” you need is, say, medication. Accurately knowing how much money you have, while boring, is very, very important and a checking account wins over keeping cash every time.

Don’t be a squirrel

Okay, so keeping track of you money is nice and all, but banks fail don’t they? Wouldn’t it be safer just to keep cash in that case? You can’t lose cash in a bank failure if you don’t have cash there to lose.

Yes, that’s true! But where were you planning to put your cash instead, if not in a bank? Stuffed in your mattress? Buried in the backyard? What if you, like our woodland friends the squirrels, forget where you buried it all? What if someone breaks into your home and takes the money from your mattress?

That would suck.

Sure would. In general, having larger amounts of physical money just hanging around invites…unwanted attention from unsavory types. After all, having large amounts of physical money just hanging around is why banks themselves have big, metal vaults to store it all in! Are you going to buy a big, metal vault to store your cash?

Nah, leave it to the banks and just get a checking account. Having your money in a checking account means it’s safely tucked away in the bank (in their vault!). You can’t forget where you buried it and burglars can’t just up and steal it from your mattress. Oh, and those pesky bank failures? Don’t sweat it. A government-backed insurance company called the “Federal Deposit Insurance Company” or “FDIC” has you covered. If your bank fails, the FDIC pays you back all the money you had in your checking account, up to a limit of $250,000 per account, per bank. Just make sure to set up your account with an FDIC-insured bank and you’re good to go. Way safer than stuffing it in a mattress.

Your money will make money

And finally, I have a secret to tell you: a checking account is, to the bank, considered a loan. Yup, you heard me right. It’s a loan! To the bank. From you. You give them your money, they hold onto it and, whenever you want it back, they MUST pay it all back to you promptly. This fact will be important later when we talk about loans but, for now, just understand that your checking account is a loan to the bank that must be paid back to you when you want it to be paid back.

If it’s a loan, then shouldn’t the bank be paying me interest? That’s what I have to do with my car loan.

Well said. That brings us to our final benefit of having a checking account: your money in the bank can make you money, even while you’re sleeping. That’s right! Remember when I said your money is a loan for the bank? I wasn’t kidding! Banks need deposits to make loans of their own so they really want you to leave your money with them. There are even some banks who want you to open a checking account with them so badly, they’ll even pay you interest on your checking account, just for putting money in it! Some will even pay you a few hundred bucks up front, just to open and fund the account! Just like any other loan, this one pays interest, but this time the interest is paid to you. Pretty nifty right?

I’m gonna be rich.

Well, uh, no. The interest paid on a checking account, if any, is almost never much money. But it’s better than making $0 in interest and it pays out all day, every day, even if you’re sleeping. Cash stuffed in your mattress can’t do that.

So get a checking account already

I hope you’re convinced that a checking account is a really smart move. It makes it super easy to know how much money you have to use on everything you need or want; it keeps your money safe, even if your bank implodes; and it’s a loan to the bank that can literally make you free money, even while you sleep. If that all is sounding great and you’re ready for your very own checking account (or ready to set up one for, say, your teenager who is getting ready to graduate high school and start life), read on to the next post and learn how simple it is to get one set up and running.

Thanks for reading.